I attend seminars or courses to learn property investing.

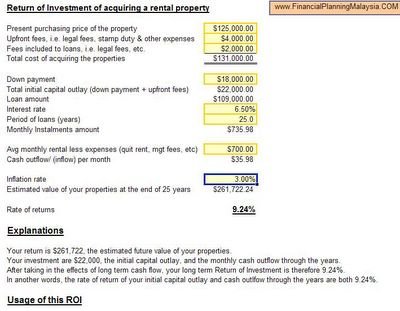

I can still remember the first property seminar that I attended many many years ago. It was an evening in one of the hotels in Kuala Lumpur. My friend persuaded me to join him to attend. The speaker was Mr Milan Doshi on strategy to buy such rental property like apartments periodically with property loans to build passive income. I can still roughly remember the illustrated numbers that he used, i.e. buy a RM120,000 apartment in every 5 years, paying down the property loans with rental income. The speed of repaying the property loans will get faster and faster. By the time you retire, the passive income would have been high enough to fund your retirement.

Not long after that my wife and I bought our first rental apartment which happened to be at the price of RM120,000. The seminar gave me a perspective to invest in property and prompted me to take action.

Later, I attended seminars conducted by Robert Kiyosaki and T Harv Eker, and courses conducted by Azizi Ali, T Harv Eker, Peter Yee, etc. I remember it was the same friend that gave me a free ticket to Mines Resort to attend T Harv Eker's seminar. We later paid thousands of ringgit to attend T Harv Eker courses in Singapore's Expo. It was all worthwhile.

My friend who persuaded me to join him to attend these seminars and courses is now "ashore" or "got out of rat race". He and his wife noticed a development area in Johor Bahru while attending T Harv Eker's courses in Singapore. They brought me there to see the growing traffics of the new area and the then newly developed Jusco nearby. They bought two shops and when the project completed the price of the shops doubled. It was before 2009.

The marketing tactics that I learned from T Harv Eker's Guerrilla Business served me well. I have made progress since then for both of my personal projects and works.

There are some exciting property courses and conventions recently. Just a few weeks ago, there was this

7-day WTF Property Seminar conducted by celebrity investor Faizul Ridzuan. He started his property investment with seed capital of RM2,000. By the age of 29, he already owned 23 residential properties.

In coming week, there is another major event in property investment.

Property Investment Convention 2013 will be held on 17th and 18th August 2013. There are a panel of speakers from various disciplines of property industry. Some are expert investors from the perspective of individual, some are important figures in charge of major development areas, some are major players and agencies of the industry. For instance, the GM of PKNS (Selangor State Development Corporation) will talk about development of Selangor. You can see the panel of speakers and their topics. Interestingly, Milan Doshi is one of them.

What can we expect out of the seminar? From the mix of speakers and their topics, we can expect a 360 degree views from property investors, developers, economy and development planners, analysts and economists, agencies and property portals, etc.

There are topics like major developments in Selangor and next hot spots in Kuala Lumpur, markets & economy outlook, strategy to build passive income, government polices on house prices, etc. You can follow the link to

read about the speakers and their topics.

In a way, I am promoting this event as an affiliate. However, I think the event is good enough for me to write and promote it. It is worthwhile.